Guaranteed personal income tax deduction for dental treatment and prosthetics in 2019

A tax deduction is a social benefit for personal income tax payers. Its essence lies in the fact that the state is ready to reimburse a person for a part of the money spent in the form of a partial or full income tax return. As is known, for treatment, implantation and other prosthetics you can get a tax deduction of up to 120 tons.

Legal regulation of cost recovery

The standard tax deduction for paid dental services is provided on the basis of the following legislative acts:

- Article 219 of the Tax Code, which sets the maximum amount of compensation.

- Article 210 of the Tax Code, indicating the maximum deadlines for submission of documentation required for registration.

- Government Decision No. 201 (as amended on June 26, 2007) establishing a list of medical services and medicines for which income tax refunds may be made.

- Letter of the Federal Tax Service No. ED-3-3 / 4646, in which the reasons for the refusal to pay compensation are given.

- Letters of the Ministry of Social Development No. 26949 / MZ-14 and the Ministry of Finance No. 03-04-05 / 7-146, which give key signs of expensive treatment requiring an increase in deduction (installation of implants, bridges, etc.).

- Letter of the Ministry of Finance No. 03-04-07 / 2789 explaining the situation of refund only for payment of services.

Compensation Terms

A person can apply for a tax deduction for complex dental treatment if he:

- Received income subject to standard tax of 13%;

- paid for dental services at his own expense;

- He turned to a clinic in the Russian Federation, which has a Russian license for medical activities.

The exception is the clinics and hospitals of the Crimea and Sevastopol, which for a long time operated on the basis of Ukrainian licenses.

From the fact that personal income tax is returned, a person is not recognized as tax evader, he can freely cross the borders of the Russian Federation.

How many times in your life do you get a deduction

A personal income tax return for dental services can be received annually in the amount established by the legislation of Russia. The deduction for dental treatment is listed in the next tax period.: in 2019, a person could receive money for dental services provided in 2018.

Expenses for medical services can be compensated within 3 years after their provision, for example, in 2019 it was possible to issue a refund for 2018, 2017 and 2016. Amounts for different tax periods do not add up, the balance of the put 120 thousand rubles is not carried forward to the next year. Therefore, the maximum benefit (based on the size of the deduction) is: 120,000 rubles x 0.13 = 15,600 rubles.

Dental Services Included

The social return of personal income tax for dental treatment covers the costs of:

- payment for inpatient and outpatient dental treatment at home and close relatives;

- purchase of necessary medicines;

- VHI insurance in dentistry;

- sanatorium-resort health improvement;

It is not the voucher with food and accommodation that is compensated, but all types of treatment: diagnosis, examination, therapeutic consultations, and prevention.

Deduction of personal income tax for expensive treatment

You can return the tax deduction for dental treatment in the amount of more than 120 tonsif you can prove that it is expensive. In dentistry, these procedures are standardly referred to:

- implantation;

- replantation;

- dental prosthetics;

- installation of metal structures: braces, bridges.

The state will fully refund 13 percent of the amount paid for these procedures, subject to the conditions:

- in the contract for the provision of services there is a clause on the acquisition of materials independently by the patient;

- the medical facility does not have the required medication;

- consumables that are needed for expensive treatment are on the medical list of Resolution No.201;

- the clinic issued a taxpayer certificate with code 2.

Refusal of cash compensation

Tax refunds are not provided:

- non-working pensioners who have no working income for the last 3 years, since the pension is not subject to taxation;

- unemployed people;

- IP on STS and UTII;

- foreigners who have received any income in Russia who are not classified as tax residents of the Russian Federation (tax is calculated at a rate of 30%, and not 13%);

- people who began to treat their teeth in foreign medical institutions.

Receipt procedure

To receive the personal income tax deduction, you must submit an application and a documentary kit to the tax office or at the place of work. IFTS is better to appear in person, although the law allows the representative to submit papers by proxy.

Documents for tax deduction for dental treatment

To receive a tax deduction for treatment or dental implantation, you must submit the following documents to the IFTS:

- 3-personal income tax return with official income information;

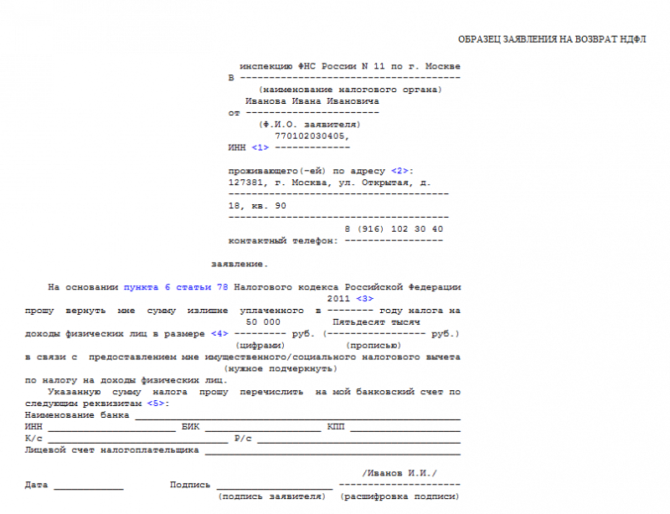

- an application that is executed in handwritten or machine-generated manner;

- 2-NDFL certificate for the required period of time (taken from the employer);

- identity card and its copy;

- copy of TIN;

- certified copy of the contract with the clinic;

- copy of the institution’s license with a list of permitted types of medical work;

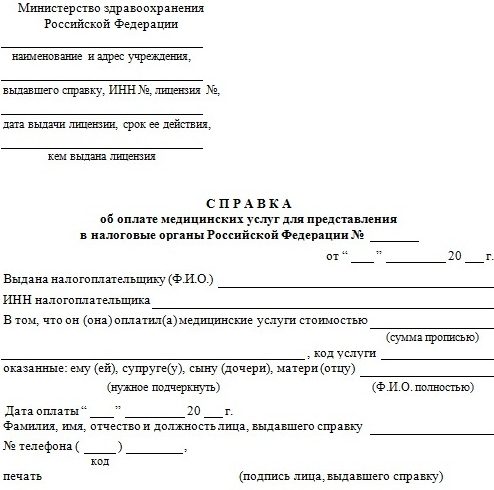

- certificate of the established form from a medical institution for submission to the IFTS (drawn up in the accounting department of the clinic);

- Documents confirming payment: cash receipts, receipts, etc .;

- a certified prescription form with the prescription of medicines, which is issued in the form 107-1 / at the dentist and must be with the appropriate seals.

If a person will make a social deduction of income tax for dental treatment not at home, but at a relative (spouse, child, parents), then to this package of documents you will need to add certificates indicating close relationship.

The nuances of the application

In some IFTS, it is required to write not one, but two statements at once:

- on the provision of a deduction (based on 219 TC);

- on the return of the excess amount of the tax charge: the refund is made by non-cash method, therefore, bank details should be indicated.

The subtleties of filling out application forms should be clarified in advance by contacting a tax inspector.

Features of billing documentation

All certificates from medical institutions, receipts, cash receipts, payment orders and receipts must be issued to the person who is indicated in the contract for dental services, and not to the one who actually paid. Inconsistency in data may result in denial of monetary compensation.

If the patient brought to the tax authority a certificate from the clinic and an agreement on the provision of services, but he did not have receipts and receipts, he still has every right to receive a tax deduction for complex dental treatment. If the territorial authority of the Federal Tax Service Inspectorate refuses to pay money, you should refer to the Letter of the Federal Tax Service No. ED-4-3 / 7333 and contact the higher authorities.

Contents of a certificate from a medical institution

Although the chief accountant must fill out a certificate for the tax office according to the established model, the patient should know the points that should be in the document. These include:

- F. I. O. and taxpayer TIN;

- payment dates;

- patient card number (outpatient or inpatient);

- code: 1 - indicates conventional therapy, in which the compensation does not exceed 120 tons, 2 - indicates an expensive treatment, the cost of which is fully reimbursed.

Registration at the IFTS

The personal income tax refund procedure consists of several stages. It is necessary:

- collect the required documents for a tax refund for dental treatment;

- fill out and submit a declaration;

- bring a documentation package to the IFTS;

- wait for an answer and get the money.

The funds are not immediately refunded to the taxpayer. Within three months after the application is submitted, a desk audit is carried out, on the basis of which a decision will be made on the provision of a deduction or on refusal. In case of approval of the application the returned money to the account of an individual will be received within the next month.

If the IFTS takes too long to assess the appropriateness of the payment, having missed the deadlines set for this by law, the applicant is entitled to receive compensation for each day of delay. Its size is usually equal to the refinancing rate.

Receiving compensation from the employer

Returning money for treatment and prosthetics through the territorial tax office has one significant drawback: withholding personal income tax begins only in the next reporting period. If a person does not want to wait, he draws up a deduction from the employer.

But first you need to get permission from the IFTS. It will come in the form of a written notice within 30 days after the application. This notice should then be provided to the employer along with the required documentation kit.

Special cases

Not all situations with the deduction of personal income tax fit into the standard framework, there are several not quite typical cases.

Implant tax refund

Patients have the right to receive a full tax deduction for dental implants, since it is an expensive treatment. This procedure has several features.

Since the person in the prosthetics department is first prepared for the operation, and only then implantation is performed, then usually two certificates are issued to his hands:

Since the person in the prosthetics department is first prepared for the operation, and only then implantation is performed, then usually two certificates are issued to his hands:

- with code 1 for receiving a standard deduction from limits of 120 tons;

- with code 2 for registration of the maximum personal income tax return.

To simplify the submission of a documentary package to the tax inspectorate, these certificates should be accompanied by a printout of letters from the Ministry of Finance and the Ministry of Social Development, which define expensive treatment and say that implantation refers to it. But only the amount that was paid in the form of taxes will be returned to the patient’s account.

Personal income tax refund for foreigners

Each tax resident can receive a personal income tax deduction for dental treatment in the Russian Federation. A foreigner becomes one if he is officially in the country for more than 183 days. It was at this moment that not all 30%, but 13% began to be retained from all his income.

Once a foreigner has become a tax resident, he can count on state compensation.

But there are exceptions to this rule. If we are talking about citizens of the EAEU countries, then they are ranked as tax residents upon arrival in the Russian Federation, and therefore they calculate the tax at a rate of 13%. Therefore, they can count on a tax deduction from the very first day they are in the Russian Federation if they decide to treat and prosthetize their teeth (put implants) in local clinics along with the Russians. The compensated amount is also returned to him to an account opened with the Bank of the Russian Federation.

Pension compensation for dental treatment

Tax deductions for treatment and prosthetics for pensioners are provided only if they continue to continue to officially work, receiving a salary.In this case, he can make the return of personal income tax on a common basis.

If a person does not work, and receives only a pension, then he is not entitled to social compensation for medical manipulations. 13% is not deducted from a pension, therefore there is nothing to return the income tax for paid dental treatment from, the money was not received into the treasury.

The return of income tax for dental treatment is a standard procedure that every taxpayer is entitled to. This is a great opportunity to legally reduce your costs. This is especially true for the installation of dentures, because this treatment is extremely expensive.